Investing in real estate in the United States with the help of an international real estate agent.

It is clear that the impact of the pandemic has created a domino effect in the economy of many countries, what is also true is that all crises create opportunities and it is important to be prepared to take advantage of them, especially when such opportunities occur in a safe and stable market such as the one in the United States.

Why invest in the US?

The answer is simple, according to the United States Federal Reserve for 2021, an econonmy expansion of 6.4 percent is estimated, which would reach growth levels well above the ones seen before the pandemic.

This North American country continues to be one of the fastest growing countries in terms of real estate, as confirmed by investsouth.ca group who focus specifically on the Florida real estate market.

The average Airbnb occupancy rate by city in Florida during the first quarter of 2021 was 81.3% in Orlando, 77.6% in Miami and 69.8% in Cocoa Beach. * Generally speaking, a value of 50% or more is considered good.

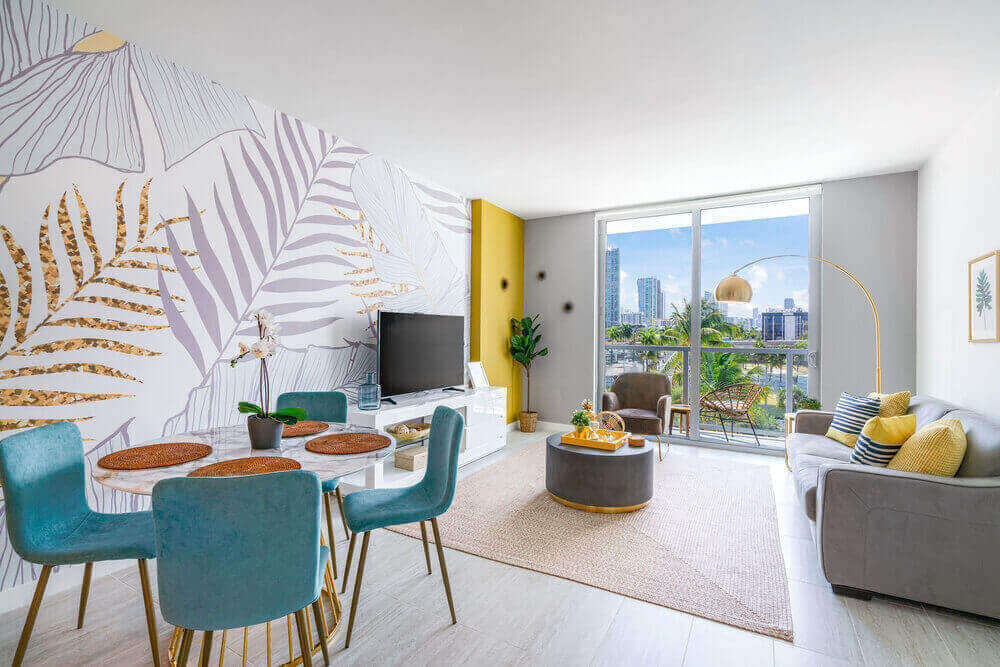

The properties marketed by the company are distributed between the two fastest growing cities in Florida: Miami and Orlando, in addition to that they are delivered, decorated and ready to be rented, which makes the profits to be seen immediately.

The properties marketed by the company are distributed between the two fastest growing cities in Florida: Miami and Orlando, in addition to that they are delivered, decorated and ready to be rented, which makes the profits to be seen immediately.

Who can benefit from this business model?

Long term Investors who want to see constant returns on their investments.

According to a report by the National Association of Real Estate Agents of the United States, Colombians are among the five largest foreign buyers of real estate in that country, with investments close to 1.3 billion dollars since April 2019.

Similarly, an article published by the newspaper La República announced in February of this year that Colombians are on the podium of those who invest the most abroad and even confirm that the private capital allocated by national companies and investors doubled in seven years and reached an accumulated amount of US $ 60,628 million.

This means that Colombian investments abroad are many, legitimate and growing.

What are the benefits of the short-term rental property investment model?

If you are interested in investing in real estate, a vacation rental can be a great place to start. Not only can it help you become familiar with finding, preparing, and financing an investment property, but it can also provide you with a nice place to get some rest. Who doesn’t want that?

Let’s now look at some of those advantages:

Make extra income

The biggest advantage of owning a vacation property is simple: you make money. Airbnb hosts make more than $ 900 per month on average, while hosts in high-demand cities can earn four times as much. And that’s only on one platform. There are dozens of other vacation rental sites out there, opening the door to even more profit if you play your cards right.

Here are some of the best vacation rental platforms that you might consider listing:

You have your own place to rest

Having a vacation rental means you can vacation there too. Use the property for your family gatherings, to take your kids on a summer vacation, to have a business meeting or host an annual family reunion.

You can deduct a lot of your expenses

If you rent the house for more than 14 days, it is considered a business for tax purposes. That means you have to pay taxes on the income you generate, but it also allows you to pay off many of the expenses you will incur to repair and maintain the property.

You can deduct almost any “ordinary and necessary” cost of doing business. You can even cancel the accommodation fees charged by Airbnb and other platforms.

Here’s a list of items you might consider deducting as a rental investor:

- Lodging rates.

- Cleaning costs.

- Supplies (toilet paper, glasses, etc.).

- Occupancy taxes.

- Insurance premiums.

- Utility costs.

- Lawn maintenance.

- Property management fees.

- Mortgage interest.

This is not an exhaustive list, so speak with a financial advisor or accountant to maximize your deductions.

You have a new savings reserve or a future retirement home

A vacation home can be a great way to build long-term wealth and ensure healthy finances when you retire. Sell it and use the cash to cover your future costs of living, travel, healthcare and more. Or stay and enjoy the relaxing retirement you’ve always envisioned. Either way, you always win.

By Alejandro Azuero

International Sales Manager

Real Estate Agent USA License No BK3400589

Mortgage Broker Canada