A short-term rental real estate investor is an individual or entity that focuses on acquiring properties with the intention of renting them out on a short-term basis, often through platforms like ISDV, Airbnb, VRBO (Vacation Rental By Owner), or other similar services. Unlike traditional long-term rentals, where properties are leased out to tenants on an annual basis, short-term rentals are typically rented out for shorter durations, ranging from a few nights to several weeks.

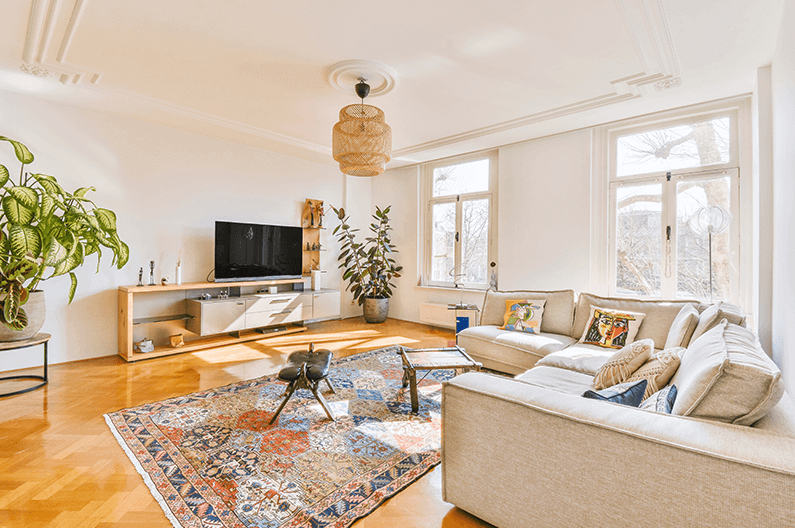

Short-term rental real estate investors seek to capitalize on the growing popularity of vacation rentals and the sharing economy. They identify properties in desirable locations, such as tourist destinations, urban centers, or areas with high demand for temporary accommodations. These properties are often furnished and equipped with amenities that make them attractive to travelers looking for an alternative to hotels.

Key characteristics of short-term rental real estate investing include:

Higher Rental Income Potential

Short-term rentals can generate significantly higher rental income on a per-night basis compared to traditional long-term rentals. This is especially true in areas with strong tourist or business demand.

Flexibility

Investors have more flexibility in using the property themselves or making it available for friends and family when it’s not rented out.

Property Management

Managing short-term rentals involves coordinating guest check-ins, cleaning between guests, and addressing any maintenance or guest-related issues.

Market Research

Successful short-term rental investors conduct thorough market research to determine demand, optimal pricing, and competitive landscape in the chosen location.

Regulations and Compliance

Short-term rental investors need to be aware of local regulations, zoning laws, and homeowners’ association rules that pertain to short-term rentals.

Seasonality

Rental income can be influenced by seasonality and demand fluctuations, which may require adjusting pricing strategies.

Reviews and Reputation

Positive guest reviews and a good reputation are crucial for attracting more guests and maintaining a consistent stream of bookings.

Vacancy Risk

Short-term rentals may experience higher vacancy rates during off-peak seasons or slower travel periods.

Short-term rental real estate investing can be profitable, but it also comes with unique challenges and considerations. Investors need to manage guest interactions, property maintenance, and operational logistics to ensure a positive guest experience.

Like any investment strategy, it’s important for short-term rental real estate investors to thoroughly research the market, understand the financial implications, and be prepared to adapt to changing market conditions that is why is important to contact a real estate professional such as InvestSouth.