Miami’s real estate market continues to attract both domestic and international buyers, driving property prices upwards. In 2024, Miami remains one of the top destinations for real estate investments in the U.S., with the average home price hovering around $600,000, a notable increase from previous years. The luxury condo market, in particular, is seeing growth, fueled by demand from foreign investors.Miami’s strong job market, growing tech industry, and international appeal contribute to the high demand for properties. The city’s tropical climate and lifestyle continue to attract new residents from around the world. Additionally, Miami is emerging as a technology and finance hub, attracting high-net-worth individuals looking for both primary residences and vacation properties. Rental properties, particularly in urban areas, are in high demand, with occupancy rates remaining strong.

Experts predict a steady increase in property values over the next five years, with an annual growth rate of approximately 4-6%. This growth is largely due to Miami’s appeal as a business-friendly city with no state income tax, making it a haven for both residents and investors. Furthermore, the influx of remote workers and digital nomads is expected to boost demand for short-term rentals, especially in luxury properties.

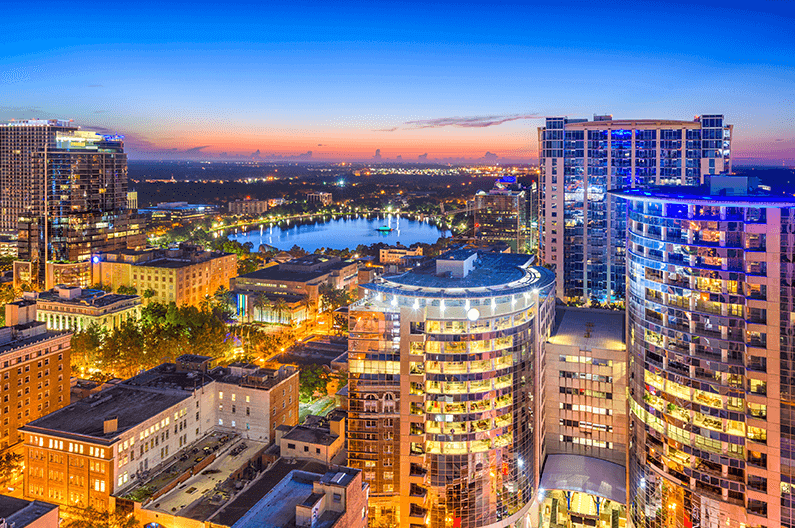

Orlando’s real estate market, known for its affordability compared to other major cities in Florida, is experiencing a steady rise in property prices. The average home price in Orlando is currently around $400,000, showing consistent growth year over year. The city’s family-friendly reputation and proximity to world-famous theme parks, such as Disney World, make it a hotspot for residential and vacation property investors alike.

One of the key drivers of demand in Orlando is the tourism industry. With millions of visitors flocking to the area each year, short-term vacation rentals are a lucrative investment. The rise of remote work has also encouraged more families and professionals to relocate to Orlando, increasing the demand for residential homes. Additionally, the local economy is diversifying, with growth in healthcare, education, and tech sectors, which boosts the need for both rental and for-sale properties.

Orlando’s real estate market is expected to see a 3-5% annual increase in property values over the next several years. Factors contributing to this growth include the continuous expansion of theme parks, infrastructure projects, and the city’s affordable living compared to other Florida metros. Orlando is projected to remain a strong market for both residential and investment properties, with increasing interest from out-of-state buyers.

Strong Investment Opportunities in Miami and Orlando

Both Miami and Orlando present unique opportunities for real estate investors. Miami offers a more luxury-focused market, attracting high-end buyers and international investors, while Orlando provides more affordable, family-oriented investments with strong returns from vacation rentals.

We are committed to guiding investors through these exciting markets, helping you capitalize on current trends and prepare for future growth. Whether you’re looking for a property in Orlando or Miami, our team of experts is here to assist you every step of the way Contact us!